What is Mortgage Life Insurance?

Mortgage Life Insurance, or often referred to as just "Mortgage Insurance" (no to be confused with Canada Mortgage and Housing Corporation (CMHC) insurance, commonly known as "Default Insurance") is meant to protect the mortgage liability someone may leave behind if they pass away.

When someone has a mortgage and they pass away, there's still an outstanding balance on that mortgage. When this happens, their family and dependants may not be able to afford the mortgage payments or be able to stay in the family home.

Mortgage Life Insurance helps protect the outstanding balance of the mortgage.

Protects your family home

For most people, their home is probably the biggest investment they have ever made. Making sure their investment is protected is a smart decision.

Financial relief for you family

When a tragedy happens, the last thing your family wants to think about is paying the bills. Mortgage insurance is a great way to provide a financial safety net.

Peace of mind

Knowing that your family will be able to keep the family home without financial worries is priceless.

There's only two ways to get Mortgage Life Insurance

Through your bank or lender

This is how most people buy Mortgage Life Insurance. Too often, people accept it because their mortgage agent makes it sound like it's "part of the process".

However, this is far from the truth. A mortgage lender cannot make Mortgage Life Insurance a condition to obtain a mortgage, and neither is it mandatory.

This coverage offered through lenders is often much more expensive than superior coverage offered through a Life Insurance Company.

Even

CBC Marketplace has made a documentary explaining why banks' Mortgage Life Insurance is one of the

worst financial products available.

Through a Life Insurance Company

This is the best and more affordable way to get Mortgage Life Insurance.

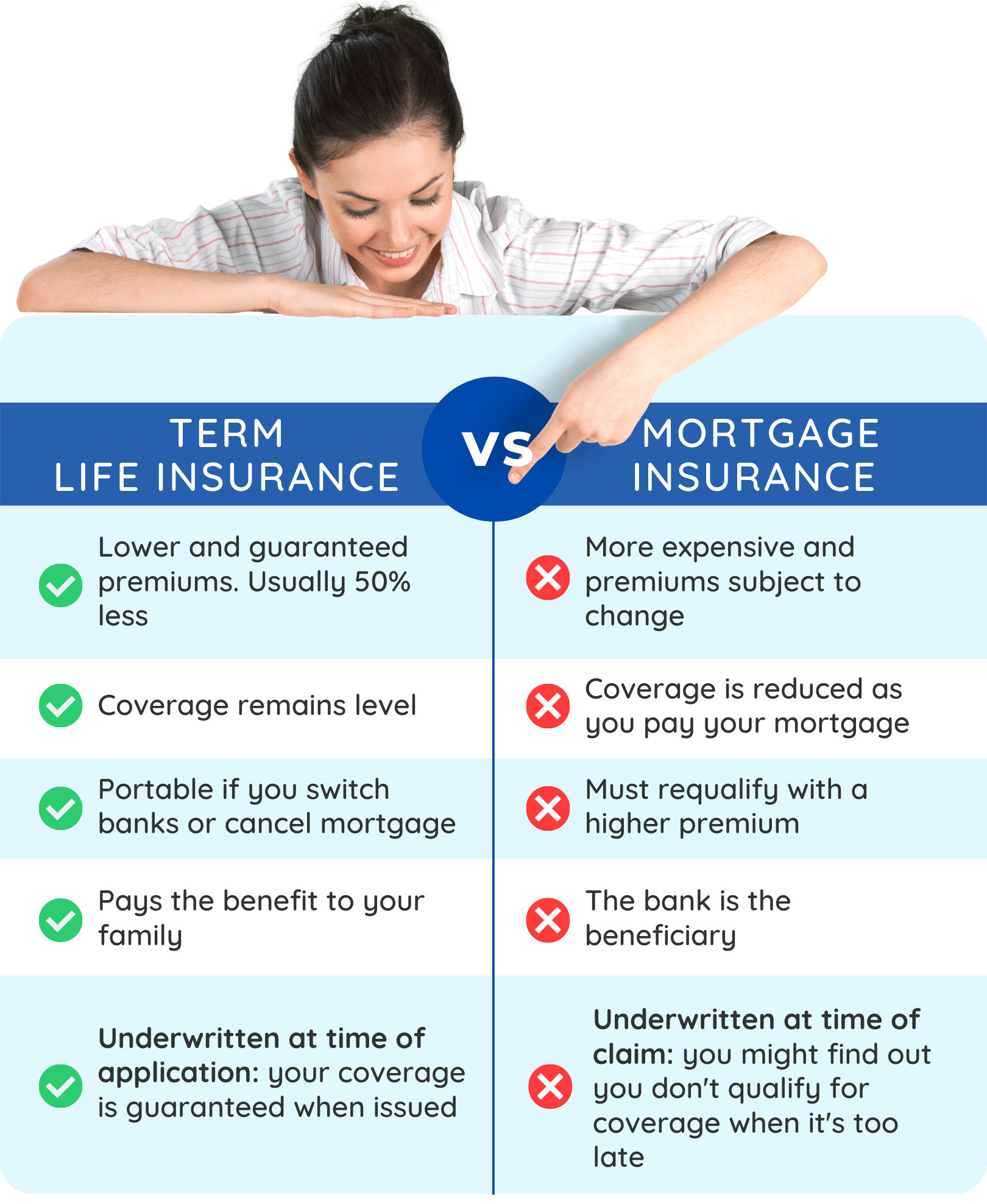

Besides the opportunity to save thousands of dollars over the life of your mortgage, there are many more benefits available on Individually owned Life Insurance.

Individually owned Life Insurance, offers a great degree of flexibility and peace of mind that banks' mortgage insurance does not.

This type of coverage is portable and not tied to your bank. and it also offers lower and guaranteed premiums.

We have created a case study and a comparison table outlining the

advantages and benefits of individually owned term life insurance.

Case study and example

Matt and Leslie are both 40 years old and just bought their first home. Here ar the details below:

Bank: TD

Mortgage Balance: $600,000

Amortization: 25 years

Payment option: Monthly

Mortgage Balance in year 15: $309,194.65

They understand that protecting their home is a top priority and they look at the options below.

Mortgage Insurance through the bank

TD Mortgage Protection Quote

Initial coverage:

600,000

Monthly Premium:

$200.24*

(including discounts)

*This premium is subject to change in the future

Monthly Savings:

$0

Savings over 20 years:

$0

If Matt were to pass away at year 15

TD Mortgage Protection would pay to:

The Bank:

$309,194.65

(mortgage balance)

LesIie:

$0

Even though Matt and Leslie were paying a higher premium, if Matt were to pass away, the Mortgage Protection plan would only pay to the bank the balance of the mortgage and leave Leslie with no additional funds.

Individual Term Life Insurance

Empire Life 20-year Term

Level coverage:

$600,000

Monthly Premium:

$90.36*

(including discounts)

*This premium is contractually guaranteed

Monthly Savings:

$109.88

Savings over 20 years:

$26,371.20

If Matt were to pass away at year 15

Empire Life would pay as follows:

The Bank:

$0

LesIie:

$600,000

With this option, the benefit amount always remains level. The benefit is paid directly to Leslie and she can choose to pay the mortgage balance and still have additional money to cover funeral expenses and for her family.

Check out CBC Marketplace's documentary:

In Denial - Regarding Mortgage Life Insurance in Canada

How to Buy Life Insurance

Although in today’s digital age you can buy insurance in many places, and online, it is always best to work with an independent insurance advisor, who can guide you through the options that will fit your specific needs and long-term goals.

What is Life Insurance?

Put simply, if you were to pass away, life insurance will help protect your loved ones financially. There are two primary types of life insurance — term or permanent. Term life insurance provides insurance protection for a set period — typically 10 to 40 years. Permanent insurance provides coverage for life.

How Does Life Insurance Work?

A life insurance policy is a contract between you and an insurance company. In exchange for your premium payments, the insurance company provides the coverage amount, also known as the death benefit, to your named beneficiaries should something unexpected happen to you.

Do I Need Life Insurance?

A simple rule of thumb is if you have shared debts or anyone relies on your income for their financial well-being, you should consider getting life insurance coverage. And every person’s life insurance needs are different and depend on many factors, such as how many dependents you have, how much you expect to earn, and even your gender.

FAQS

Got questions? We’ve got answers.